With digital transactions exponentially on the rise, fraud detection and risk management have never been of higher stakes. Systems with preordained rules and manual evaluation are no longer sufficient to deal with further sophisticated ways of executing a fraudulent activity. Making way is AI in Machine Learning, an agent of change that is currently altering the whole notion of fraud detection and risk management in organisations. AI-assisted systems are finding subtle patterns, flagging anomalies, and predicting threats faster than any human or traditional software can. By learning from huge datasets and adapting in real time, these intelligent models work toward increased accuracy and reduced false positives.

From finance and insurance to e-commerce and healthcare, industries are increasingly relying on Machine Learning’s AI to help prevent fraud—in ways that are smart, fast, and scalable. The models act both as detectors of fraudulent activities and reducers of operational, financial, and reputational risk.

This blog will look into the ways AI in Machine Learning across sectors is used to detect fraud, manage risks proactively, and set up digital security better. Alongside, I’ll shed light on certain AI methods, may present some practical examples, and take you through how platforms like Azure make AI adoption effortless and enterprise-ready.

How Has Fraud Detection Evolved Over Time?

The fight against fraud has gone from intervention-based approaches to prevention. The modern AI and Machine Learning-empowered systems analyze human behavior in real time and mark suspicious activities before harm occurs.

Real-Time Anomaly Detection

These models continuously monitor transaction patterns. Any change from normal activities, such as a sudden increase in transaction volume, is immediately flagged for review.

Pattern Recognition and Learning

In contrast to traditional rule-based systems, an AI learns from instances in the past. This helps the AI discover fraud patterns that may change over time so that systems do not get stuck onto outdated detection mechanisms.

Reducing False Positives

One major challenge with traditional fraud systems is the high-false positive rate. ML algorithms learn from past instances, thus reducing alert fatigue and helping the analysts focus on real threats.

How AI Enhances Risk Management?

Fraud is the least understood side of risk. Organizations are thwarted by operational, financial, and regulatory risk. The integration of AI-generated Machine Learning into the risk systems imparts a dynamic, data-centric approach, which evolves with the environment.

Predictive Risk Scoring

AI determines the risk of a future event, such as a loan default or a regulatory breach, based on historical and real-time data. In turn, the consequences are the most informed decisions.

Real-time Risk Monitoring

With risk management AI, automated dashboards can be set up to monitor high-risk zones, transactions, or vendors and act swiftly when anomalies are detected.

Strategic Decision Support

This AI enables the executives to come up with strategic decisions backed by evidence by providing insights into what is happening and why.

What Are the Core Types of AI Used in Fraud and Risk Management?

A machine learning technique can depend on the scenario of the risk being considered. Various types of AI in Machine Learning are used, depending on data availability, the targeted outcome, and complexity.

Supervised Learning

Used when the data set has labeled examples (say, known cases of fraud). The model generalizes the concept of fraud and applies it on new data.

Unsupervised Learning

When data is there in any but not labeled. It detects clusters or anomalies in data, which can reveal previously unheard-of ways of perpetrating fraud.

Reinforcement Learning

It is applied in dynamic environments such as trading, gaming, and others. The AI learns from feedback and helps make better decisions with every single interaction.

What are the Real-World Applications of AI in Fraud Detection?

Theory is only half a story. Now, let us look through AI in Machine Learning examples in fraud detection in sectors that have successfully adopted this technology.

Credit Card Fraud

Banks identify unauthorized transactions and suspicious spending patterns in real-time via artificial intelligence. It can highlight outliers in seconds.

Insurance Claims

Difference between insurance is the detection of fake claims by analyzing history of claim, pattern of documents, and pattern of behavior of claimant. AI spots subtle inconsistencies that would otherwise go unnoticed.

E-Commerce Chargebacks

Online retailers fight return fraud and chargebacks with the help of machine learning models trained on customer and transaction data.

Strengthening Cybersecurity with AI

The two terms, fraud and cyberattacks, are often interlinked in conceptualization. With more assets being converted into their digital counterparts, cybersecurity with AI becomes essential to safeguard sensitive data and digital infrastructure.

Network Intrusion Detection

They detect abnormal traffic-type patterns or login attempts signifying that they may be intruding into the system. Alerts may be issued automatically for immediate response.

Email and Phishing Attacks

NLP is used to analyze phishing content in emails so as to lessen the risk of members of staff falling for such scams.

Endpoint Protection

The other use of AI is at the front line on devices to protect from malware, keylogging, or unauthorized access, especially in remote and hybrid work scenarios.

The Role of AI in Digital Risk Management

Digital transformation increases efficiency while presenting digital risks. AI-powered digital risk management, thereby, enables enterprises to address these vulnerabilities on a proactive basis before becoming critical to successful operations.

Vendor Risk Monitoring

Every consideration of new methods and platforms presents new risk factors. AI is utilized to monitor vendors’ digital behavior to alert against possible threats.

AI tracks data flow in the cloud to ensure compliance and the interventions about illegal access and data leakage.

Identity And Access Management

The combination of behavioral biometrics with AI authentication systems provides verification of users without exclusive reliance on weak passwords, thus ensuring stronger security for digital identities.

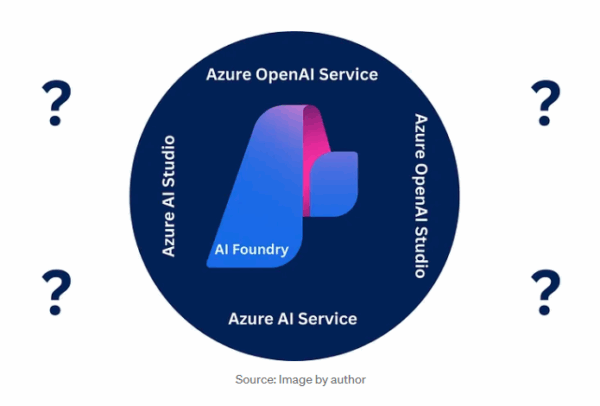

Enterprise-Grade Solutions: Azure’s Contribution

Azure-type platforms make artificial intelligence adoption simpler and scalable. With Azure Machine Learning Services, companies can create, deploy, and monitor models in a very short time and provide security for them.

End-to-End Model Lifecycle

For training, deployment, and retraining of AI models, Azure presents tools that allow organizations to continuously enhance their solutions for fraud and risk.

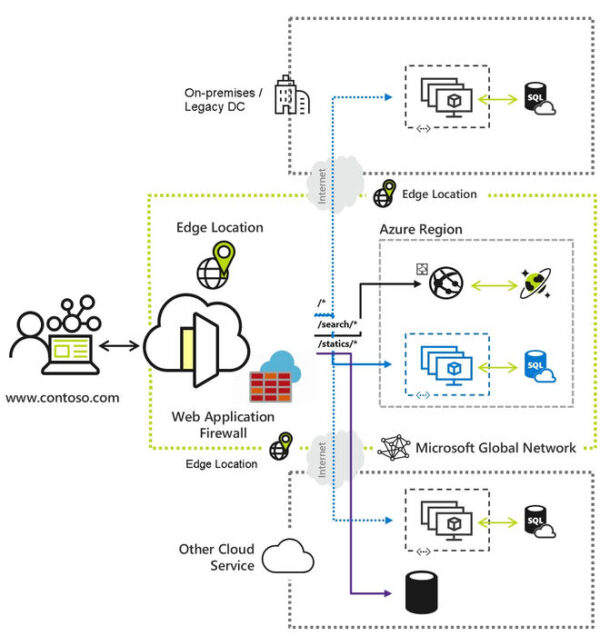

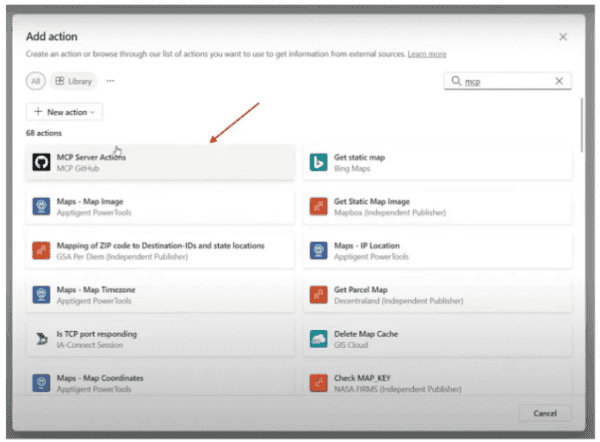

Integration with Existing Systems

Integration of Azure with existing cloud databases, ERP tools, and security software is seamless and easy, helping machine learning apply to existing workflows.

Governance and Compliance

Built-in compliance tools support industries in fulfilling regulatory requirements-a key point for finance, healthcare, and public sectors.

Building a Smarter Risk Strategy with AI

An agiler strategy does not incubate fraud but foresees it. By implementing risk management with AI, incumbents can thereby insulate the present system against any potential future variations and can sideline the Goliath adversaries.

Data-Driven Policies

Risk policies that rely on the insights from AI stick the fastest when any regulatory or market changes happen.

Scenario Planning

AI enables the simulation of “what if” scenarios so that an organization can prepare for disruptions that might include cyber-attacks, market crashes, or global complications.

Continuous Improvement

Machine learning means data. The more it is fed data, the better it becomes. Therefore, AI becomes not a one-off tool but rather an asset in a strategic sense with a long-term view.

The Future of Fraud Detection and Risk Management

As fraudsters get more technologically advanced, organizations must get faster. AI-based machine learning provides a proactive, scalable, and intelligent means to move forward.

Unified Risk Intelligence

Future systems will combine fraud, compliance, cybersecurity, and operational risk matter into a single AI-driven framework.

Governance with AI

Automated auditing, transparency dashboards, and explainable models will ease oversight, making it more accountable.

Ethical AI Use

Responsible use will be paramount to any deployment as AI spreads farther and wider, meaning issues such as fairness, privacy, and bias elimination must be tackled.

Conclusion

Presence of AI in Machine Learning for fraud detection and risk management is not merely a tech upgrade-considered instead as strategic necessity. Organizations run intelligent models that learn, adapt, and evolve to detect threats beforehand and to respond faster and make smarter decisions. With false positives under control and emerging risks projected, AI keeps a business ahead of the fraudster for their operation. As digital ecosystems grow more complex, AI-driven tools need to be embraced to build a resilient, secure, and future-ready enterprise. Intelligence is the future of risk management, and the future is here.

Frequently Asked Questions

1. How does AI in Machine Learning help detect fraud?

Machine Learning analyzes huge masses of transactional data to find suspicious patterns, anomalies, or behaviors that may represent fraudulent activities. It allows real-time monitoring and faster detection of fraud cases and fewer false positives than does a traditional approach.

2. What types of artificial intelligence techniques are used for detecting fraud and managing risk?

Typical examples will be: supervised learning, with a fraud case being labeled; unsupervised learning, to seek out unknown patterns; deep learning, to cope with complicated data sets; reinforcement learning, for dynamic risk environments.

3. Can human analysts be replaced in risk management with AI in Machine Learning?

No; it does not replace human expertise but rather complements it. AI performs repetitive tasks and identifies hidden risks, whereas analysts interpret the results, make strategic decisions, and ensure the ethical use of AI.

4. Is AI a good fit for SMBs in fraud detection?

Yes, many cloud-based solutions such as Azure Machine Learning Services hold a presence as highly scalable AI tools that SMBs can utilize without having to invest heavily in infrastructure.

5. How is data privacy maintained in AI for fraud and risk management?

Responsible AI uses encrypted data-based methods that also ensure anonymization and comply with regulations like GDPR or HIPAA for maintaining data privacy and security.

6. How is AI used for fraud detection?

AI in fraud detection analyzes pattern recognition, anomaly discovery, data validation, and historical behavior.

About the Author

Manish Gidwani

Co-Founder at Bloom | Azure Solutions Architect | Azure Migration & DevOps | Azure Managed Services | Azure AI & Cognitive Services | Driving Cloud Innovation & Digital Transformation | Hire Azure Engineers